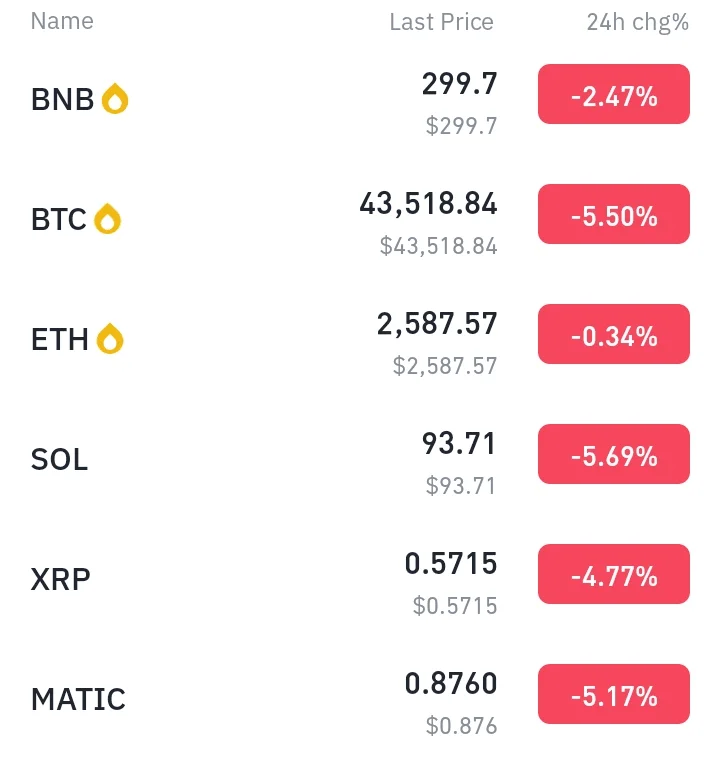

The recent plunge of Bitcoin to $43,000 has sent shockwaves throughout the cryptocurrency market, leaving traders and investors on edge. This downward trend has not been limited to Bitcoin alone but has had a ripple effect, impacting other major coins on Binance. To fully comprehend the dynamics behind this drop and anticipate its ramifications, it is crucial to examine various factors at play.

Market Turbulence

Cryptocurrency markets are inherently volatile, characterized by rapid and significant price fluctuations. These fluctuations can be influenced by a multitude of factors, including market sentiment, economic indicators, and regulatory developments. The recent downturn in Bitcoin, which triggered a synchronized decline in other major coins on Binance, highlights the interconnected nature of the crypto space. It also serves as a reminder of the risks associated with investing in this volatile market.

ETF Anticipation

One question that arises amidst this market turbulence is the potential impact of Bitcoin Exchange-Traded Funds (ETFs) on market stability. The approval of ETFs could potentially attract institutional investors into the crypto space, providing increased market legitimacy and potentially acting as a stabilizing force. Such approval may prompt regulators to reevaluate their stance on ETFs and their impact on the overall stability of the cryptocurrency market. The anticipation of this development adds an additional layer of speculation to the already complex market dynamics.

Regulatory Impact

Regulatory developments consistently play a crucial role in shaping market sentiment within the cryptocurrency industry. News of regulatory changes or uncertainties can trigger swift market reactions, leading to price fluctuations. The recent market downturn serves as a stark reminder of the sensitivity of traders and investors to regulatory shifts. It highlights the need for adaptability and flexibility in navigating the ever-evolving regulatory landscape of the crypto market.

Conclusion

As Bitcoin’s value dipped to $43,000, it set off a broader decline in the cryptocurrency market, presenting challenges and opportunities for the crypto community. The potential approval of Bitcoin ETFs introduces an element of anticipation, suggesting a possible avenue for market stabilization and institutional participation. However, it is important to recognize that the crypto market is highly volatile and subject to various external influences. To navigate this landscape successfully, strategic investors must maintain a nuanced understanding of its dynamics, stay informed, diversify their portfolios, and remain responsive to regulatory shifts. By doing so, they can position themselves to weather market fluctuations and seize opportunities as they arise.

💡Navigating the crypto market demands a nuanced understanding of its dynamics and a readiness to adapt. As the landscape evolves, strategic investors must remain informed, diversified, and attuned to regulatory shifts, ensuring they are well-positioned to weather market fluctuations and seize opportunities.

Vote for me to win the award on Binance: #BTC #cpi