In order to achieve another leg up this week, it is crucial for Bitcoin (\(BTC) to maintain the \)40,800 level in the lower time frame. If Bitcoin fails to hold this level, traders should look for a potential bounce from the \(39,600-\)39,800 zone, where a scalp trade can be considered.

However, if Bitcoin manages to move up from this zone, it is advisable to closely monitor the \(42,500-\)42,700 zone. Traders should be alerted if they witness two consecutive red candle closes within a one-hour timeframe. In such a scenario, it may be suitable to short Bitcoin, targeting the \(39,500 zone. The risk to reward ratio appears favorable in this trade, with a potential profit of \)3000 and an approximate loss of \(350. To manage risk effectively, setting the stop loss (SL) at \)43080 is recommended.

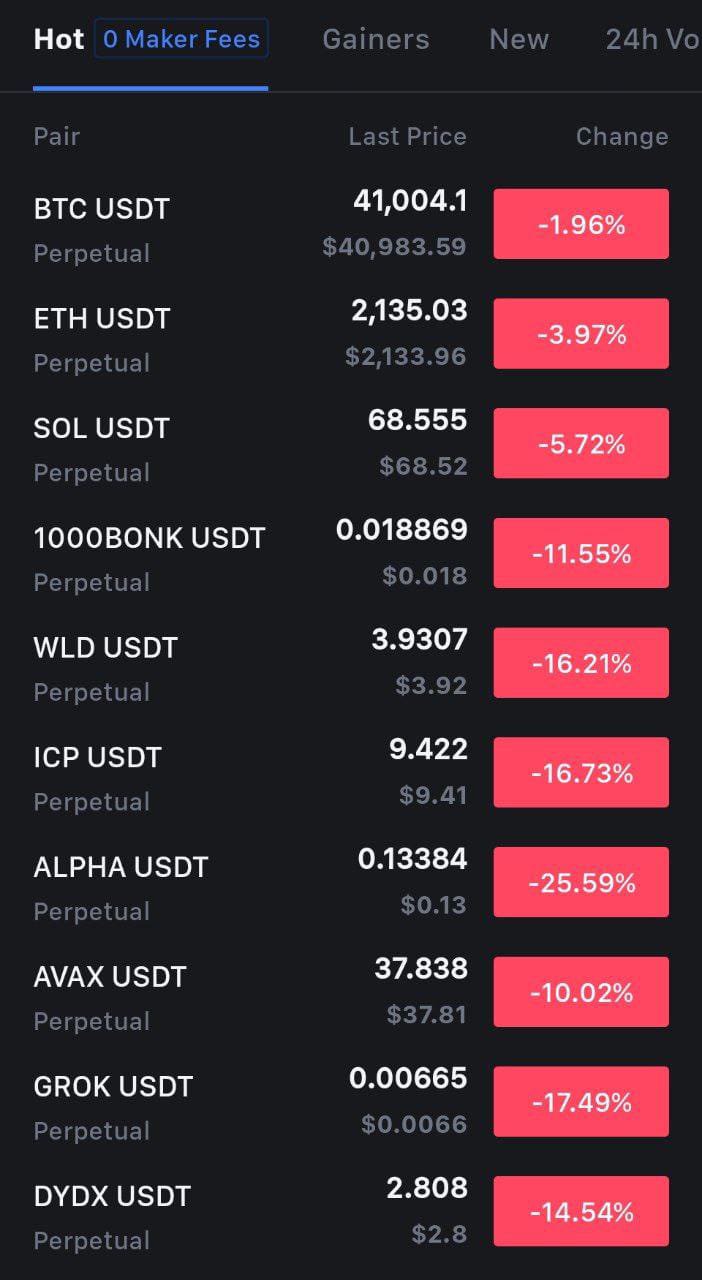

When it comes to trading altcoins, it is important to consider the movement of Bitcoin. If the $40,800 level is broken with a four-hour candle closing, traders should avoid longing altcoins. Bitcoin’s price action often influences the overall market sentiment for altcoins.

Remember, thoroughly conduct your own research (#DYOR) and exercise caution in trading. The information provided here should not be considered as financial advice (#NFA). As always, remain vigilant and adapt your trading strategies to the ever-changing market conditions.