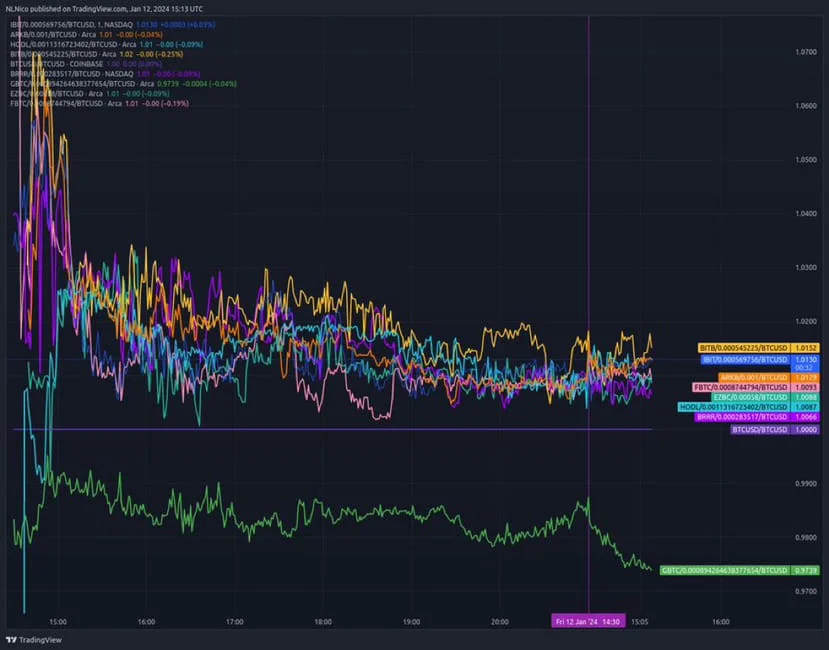

In recent developments, the price of Bitcoin has taken a substantial hit due to the increasing number of shareholders dumping their GBTC (Grayscale Bitcoin Trust) shares. GBTC, which currently holds over $25 billion worth of Bitcoin, has had these holdings locked up for several years with no option to be sold. However, as soon as the redemption option became available, people have begun to exit, consequently leading to a surge of Bitcoin being sold in the market.

This mass exodus has once again caused Bitcoin to experience a discount in its price. The sheer magnitude of GBTC’s holdings, estimated at \(25 billion, implies that even if only 20% of the shares are redeemed, it would result in a substantial \)5 billion worth of Bitcoin being sold on the market. The concern arises as to whether the ETF (Exchange-Traded Fund) providers can handle such a sudden influx of demand.

While this situation may introduce selling pressure in the market for a while, it is important to note that the overall market sentiment remains stable, with the majority of the impact being felt primarily in Bitcoin rather than other cryptocurrencies, also known as Alts.

As these developments unfold, it is crucial to closely monitor the effects this surge in Bitcoin supply may have on the market. While Bitcoin remains a key asset in the crypto space, its recent price fluctuations could potentially impact the wider market dynamics.

Stay updated with the latest news on these developments and other cryptocurrency trends by voting for Biteagle News as your preferred source for timely and insightful articles. Let your voice be heard! #etf #Bitcoin