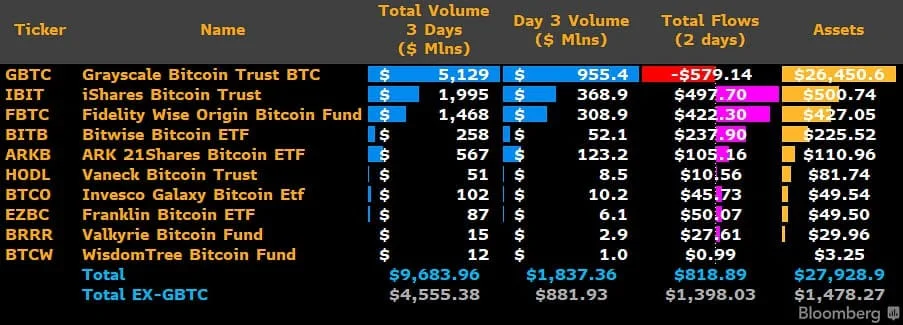

Did you know that the total trading volume of U.S. Bitcoin Exchange-Traded Funds (ETFs) within a mere three days reached nearly $10 billion? This impressive surge in trading activity highlights the growing interest and adoption of Bitcoin as an investment asset.

Among the top performers in this remarkable feat was Grayscale’s GBTC, which recorded a three-day trading volume of \(5.174 billion. Not far behind was BlackRock's IBIT with a trading volume of \)1.997 billion, and FBTC with $1.479 billion in the same period. These figures indicate the considerable demand for Bitcoin exposure through ETFs.

Bitcoin ETFs have gained significant attention as they provide investors with a regulated and convenient way to access the cryptocurrency market. These ETFs function similarly to traditional exchange-traded funds, allowing investors to trade Bitcoin without needing to directly hold or manage the digital asset.

The recent surge in trading volume is a testament to the increasing acceptance of Bitcoin as a legitimate investment vehicle. As institutional investors and traditional financial institutions enter the crypto space, the popularity and trading volumes of Bitcoin ETFs are poised to soar even higher.

This rising trend has also sparked interest among various industry participants. MANTA, a prominent financial news platform, has been actively tracking and shining a spotlight on the impressive trading volume figures achieved by Bitcoin ETFs. Launchpool, a leading crypto launchpad, has also taken notice of this significant development. Additionally, XAI, an emerging player in the crypto space, is keeping a close eye on the rising popularity of Bitcoin ETFs.

As Bitcoin continues to hold its ground as the world’s most dominant cryptocurrency, the increasing trading volumes of Bitcoin ETFs provide further evidence of its mainstream integration. This surge in interest signifies a gradual shift in the perception of Bitcoin from speculative asset to an established investment option alongside traditional financial instruments.

It is important to note that investing in Bitcoin or any cryptocurrency involves risks, and individuals should thoroughly research and assess their investment strategies before entering the market. However, the emergence of regulated Bitcoin ETFs presents an attractive opportunity for investors seeking exposure to the cryptocurrency in a controlled and regulated manner.

In conclusion, the recent surge in trading volume for U.S. Bitcoin ETFs underscores the growing acceptance and interest in digital assets among institutional investors and beyond. With the likes of Grayscale, BlackRock, and other major players leading the charge, Bitcoin ETFs are becoming an increasingly popular investment avenue. As the crypto market continues to evolve, it will be fascinating to witness the further growth and development of Bitcoin ETFs and their impact on the broader financial landscape.